Volume Profile, Order Flow VWAP, Volumetric Bars

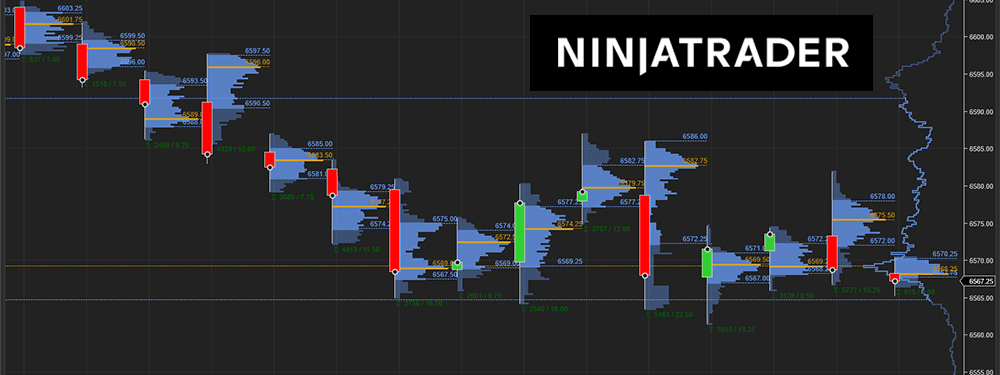

The NinjaTrader Volume Profile Indicator is a trading tool that shows the volume of trades executed at various price levels within a given time frame. Unlike traditional volume indicators that track volume over time, the Volume Profile emphasizes price points with the highest trading activity. This helps traders spot key levels of buying and selling interest, such as support and resistance zones, and identify trends or potential reversals. It is frequently used in order flow analysis to help decision-making.

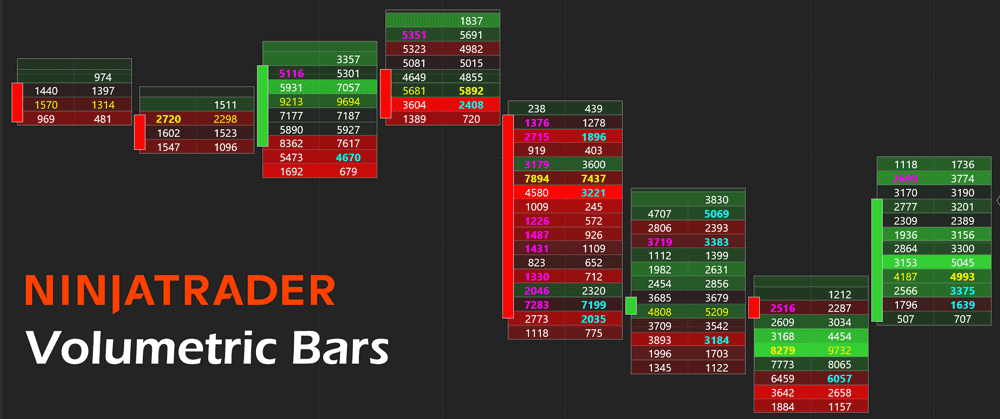

The NinjaTrader Volumetric Bars are a specialized charting tool that offers detailed insights into market activity by displaying the volume of buy and sell orders at each price level within a single bar or candlestick. Unlike traditional bars or candlesticks, which show only price movement, Volumetric Bars break down the total volume into buying and selling pressure. This helps traders accurately assess order flow, market sentiment, and potential reversals. Advanced traders often use them to fine-tune entry and exit points and gain a deeper understanding of market dynamics.

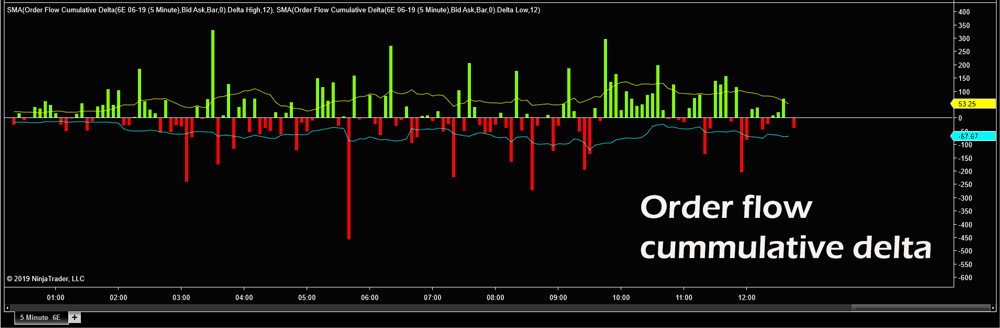

The NinjaTrader Order Flow Cumulative Delta tool measures the net difference between buying and selling volume over time. It aggregates the total of aggressive buy orders (market buys) minus aggressive sell orders (market sells) to indicate whether buyers or sellers are in charge of the market. By tracking Cumulative Delta, traders can detect changes in market sentiment, identify divergences between price and volume, and make more informed decisions about potential trend reversals or continuations. This tool is frequently used in order flow analysis to enhance trading strategies.

There are many more order flow tools available with NinjaTrader not listed here, the full premium feature set is available with a Lifetime account plan or can be added separately for a monthly fee.

If you would like to try our free volume analysis tools, you can download them from at our web store.